Revolutionize Banking with Our Neo Banking Solution

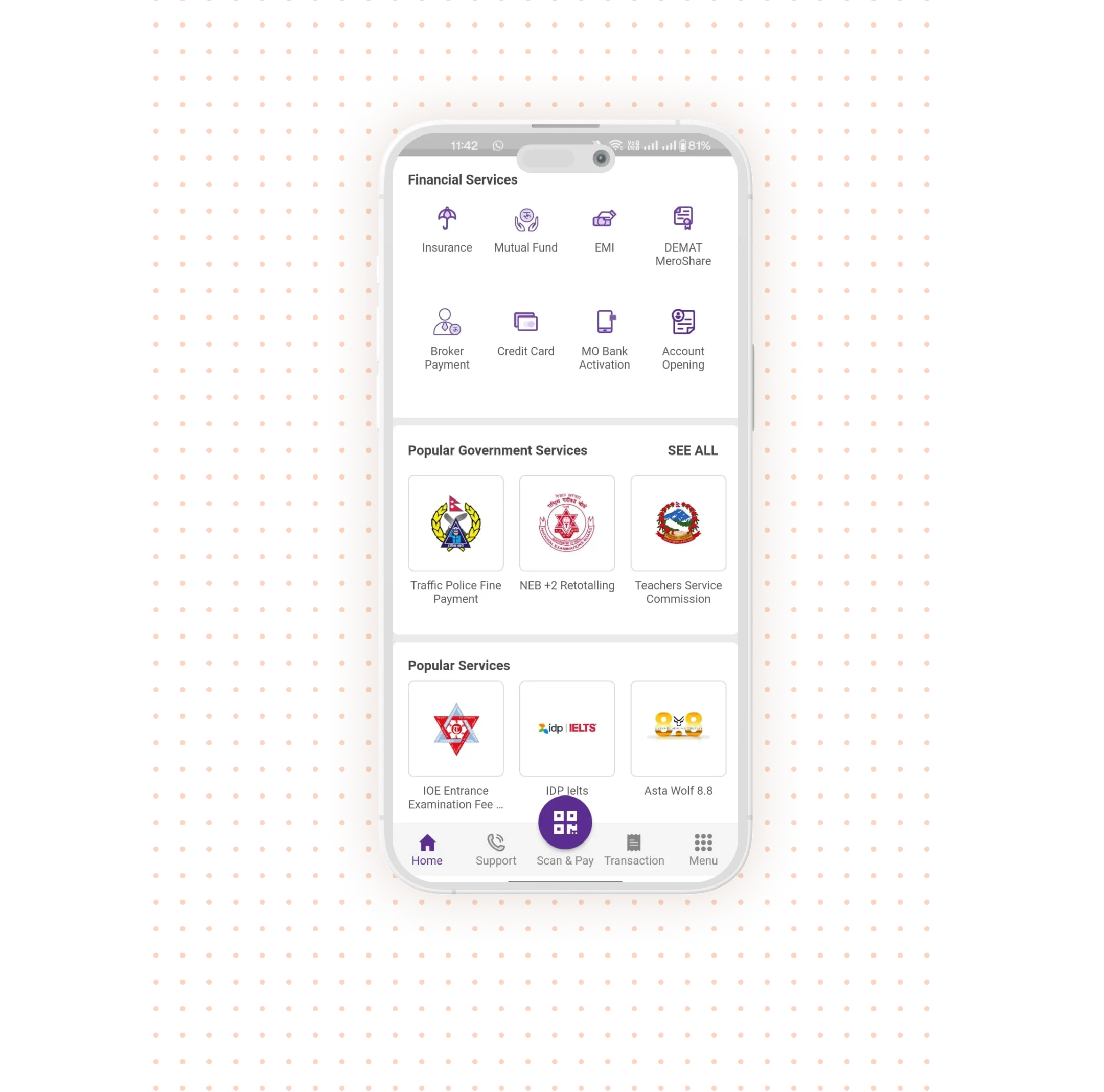

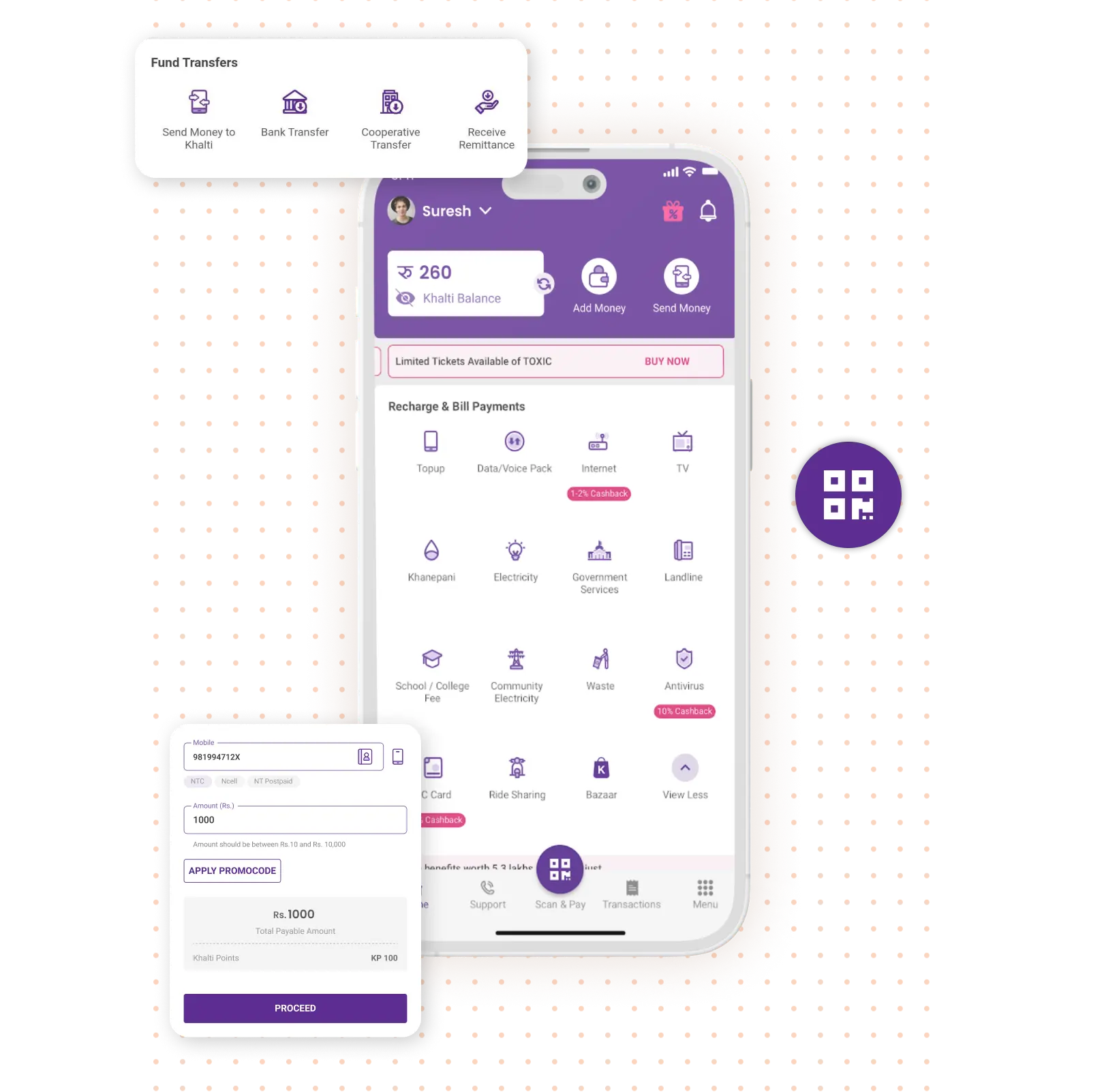

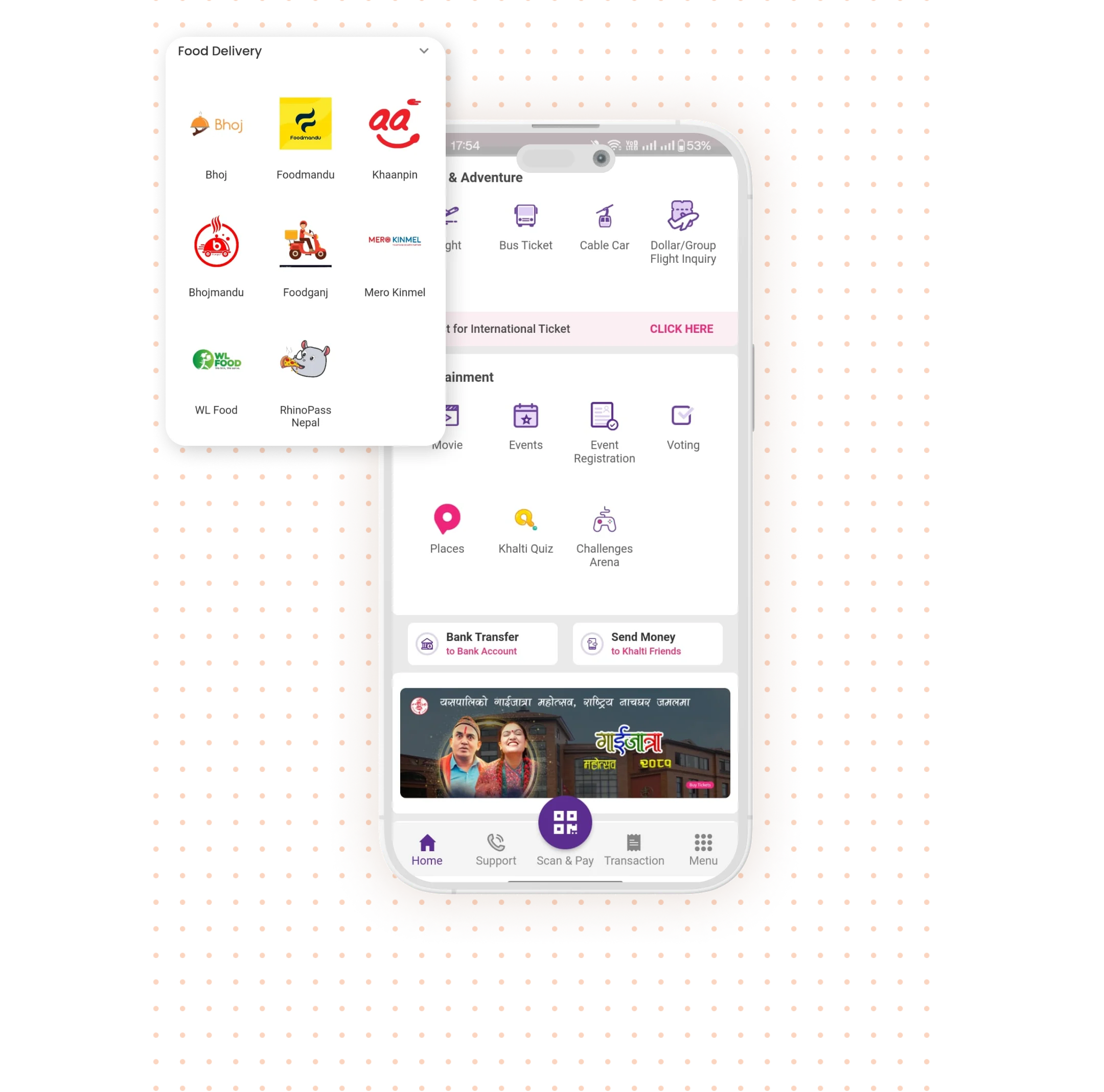

Lambda Payments brings you the next generation of banking with our White Label Neo Banking solutions. Designed to meet the demands of the modern digital age, our platform offers a comprehensive, secure, and user-friendly banking experience that puts you in control of your financial future. Our digital banking core has all the essential modules for account management, security, card issuing, lending, rewards, and reporting, as well as white-label applications for launching a digital banking service.

- Launch Fast with Ready Digital Banking Capabilities: Accelerate your market entry with the right MVP for your customers, whether it’s a digital account linked to a card, digital payments to encourage usage, or other features. The choice is yours.

- Benefit from Our Expertise & Guidance: Collaborate with us to define your business model and monetization strategy, ensure regulatory compliance, and phase out the project scope for minimal complexity and risk.

- Start with or without a Core Banking System: Take advantage of our pre-integrations to seamlessly connect to any third-party Core Banking System (CBS).

- Extensibility with a Breadth of Offerings: Quickly bring new products to market and extend Lambda Payments’ flexible capabilities to enrich your offerings and accelerate growth.

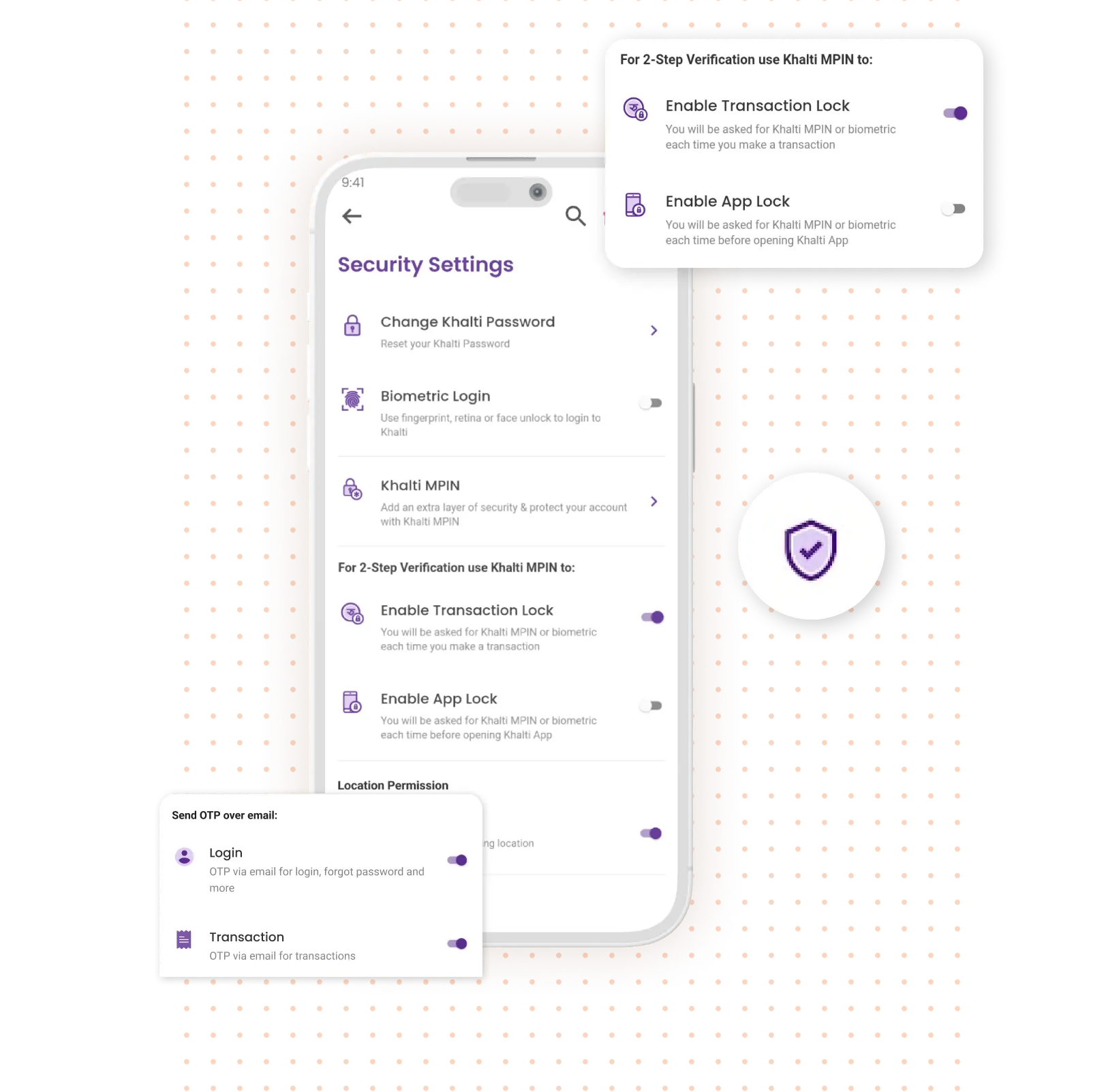

- Enterprise Integration Framework and Open APIs: Integrate with any internal or external system and third-party solutions like biometrics, tokenization, credit scoring, and more.

- Back Office Automation: Minimize costs for customer acquisition, origination, and servicing with automated, smart processes for your employees.

- Compliance, Risk Management & Security: Manage risk and integrate regulatory requirements with enterprise-grade built-in system resilience and security.

- Open, Modular Architecture: Allow for agile innovation by making quick changes to products, services, and related processes.

- Multi-Tenancy, Scalability: Handle a large number of transactions and customers with ease, supporting multiple subsidiaries with one platform.

Contact for Demo