When we hear the term “digital wallets,” we think of a wallet where we store money. And when

there is money, there are criticalities, and the users’ first priority is safety. In this article, we will

look at what digital wallet fraud is and the consequences that can follow. We’ll also look at how

organizations may protect their digital wallets.

Wanna know how digital wallets work?

The name says it all; digital wallets allow users to store and manage payment information. It

stores information such as bank accounts, credit/debit card information, and other payment

methods. A digital wallet allows you to integrate all of your payment methods into a single

account. Digital wallets make online and offline transactions more convenient for both users and

merchants.

Simply digital wallets help:

- Eliminates the need to carry physical cards or cash, enabling faster transactions at stores

and online. - Automatically fills in payment information, reducing manual data entry during purchases.

- Allows easy money transfers and payments across multiple accounts or platforms.

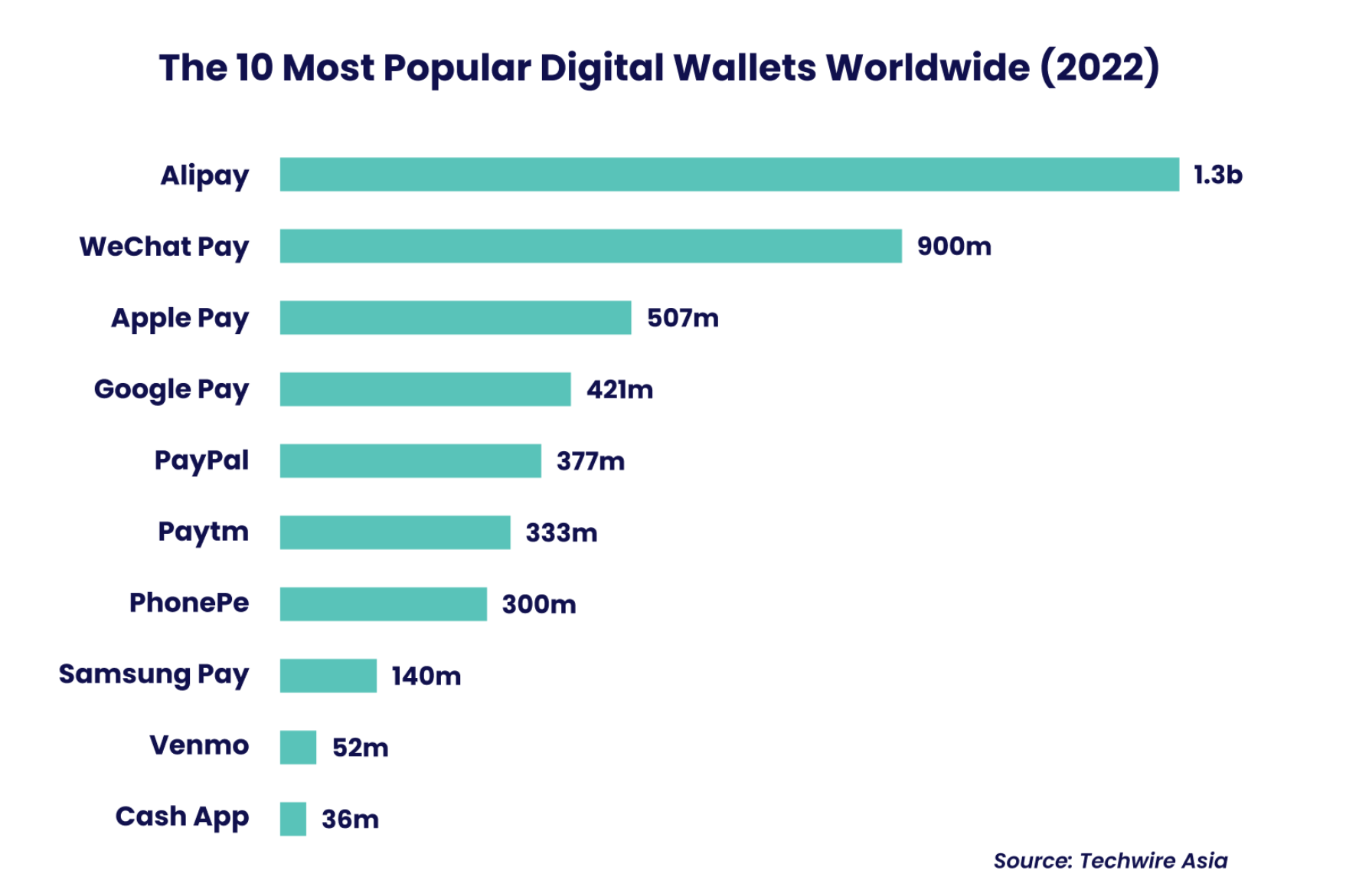

Data shows that digital wallets now account for nearly half of all online payments worldwide.

Which business leads the mobile wallet market?

What is digital wallet fraud?

Digital Wallet Fraud occurs when a person uses a digital wallet to steal money or commit fraud.

This can include breaking into an account to perform illicit transactions, attaching a stolen card

to another person’s wallet, or even the wallet owner falsely demanding chargebacks. These

activities are harmful to both users and the firms who provide the wallets.

Fraud Risks for Digital wallet

Account takeover fraud is a risk that occurs when user account information falls into the wrong

hands, allowing fraudsters to simply connect to the account, steal money, conduct unauthorized

transactions, sell login information, and engage in other criminal activities. Your digital wallet

frequently sends you messages reminding you not to share your OTP with anyone. Account

takeover occurs when a hacker gains access to your account and impersonates you, doing all

financial activities as you.

In case of linking stolen cards, Fraudsters can simply commit payment fraud by attaching a

stolen card (User A) to someone else’s (User B) wallet. Once linked, User A’s card makes

payments through User B’s wallet.

Friendly Fraud occurs when a valid consumer commits fraud by making fraudulent claims for

the transaction, resulting in a chargeback for the business. For example, customers might claim

fraud for:

- Purchases they forgot they made

- Unknown charges made by a spouse or child

- Items they regret buying

How to reduce digital wallet fraud

Use Strong Passwords: Create unique and strong passwords for your wallet account.

Enable Multi-Factor Authentication (MFA): Increase security by enabling MFA for

wallet access.

Beware of Phishing Scams: Don’t click on questionable sites or share important

information.

Monitor Transactions Regularly: Check your wallet for any fraudulent transactions and

report them immediately.

Secure Devices: Keep your phone and PC up to speed with the newest security updates.

Avoid Public Wi-Fi: Do not access wallets on unprotected networks.

Update Software Regularly: Always use the latest versions of apps and systems for

better security.

Report Suspicious Activities: If you suspect fraud, notify the wallet provider

immediately.

Want help with your digital wallet strategy?

Despite efforts to minimize digital wallet fraud, disputes and chargebacks are unavoidable and

often difficult to resolve. To properly combat fraud, real consumers must be identified and their

identities verified before any transactions can take place—a job that is practically impossible

without the right technology.

Lambda Payments provides solutions for creating a safe and dependable digital wallet while

mitigating risks. Our system confirms the legitimacy of clients by comparing their payment,

transaction, location, and device information to their digital wallet information. We also aid in

resolving invalid disputes, allowing you to reclaim revenue that legitimately belongs to you.